February 20 Newsletter

January 31, 2020

BUSINESS UPDATE

Budgets - are they useful or a waste of time?

They can promote teamwork

It's a brilliant way of thinking about the things that you want to achieve in your business during the next 12 months. It can also be a great way to engage with your team, so everyone feels part of the process and has some input. This gives the team accountability and also helps to bring the team together as they are working to achieve the same objectives.

Use historic numbers or zero-base budgeting?

There are advantages and disadvantages of both methods. By using past performance this should give you a solid foundation and allow you to tweek the numbers for growth or new product/service launches. The disadvantage of this technique is that no-one really questions the numbers, so potentially wasteful or unnecessary spending could continue because it is 'in the budget'.

Zero based budget, is exactly as the name suggests, you begin with a blank piece of paper. This potentially takes longer to do, but it does mean that each cost is discussed and questioned before they are included in the budget.

Budgets provide accountability and performance evaluation

By getting everyone involved in creating the budget, there is an implied joint responsibility for the numbers. They can also provide the basis of performance management, to encourage people to achieve and exceed their targets. There could also be additional incentives introduced, such as profit share if the company achieves a certain profit figure, again encouraging everyone in the company to pull together to achieve the budget.

Important to have regular check-ins and compare to your actual numbers

So, you have invested the time to pull together a budget and everyone has agreed it's achievable, but it really is pointless if you don't compare your budget to your actual progress. This means keeping your figures in your accounting system up to date and easily comparable against your budget. It's important to understand why you are under or over budget so that you can investigate the problem or identify an opportunity. Ideally you would compare these figures monthly, this allows plenty of time to resolve any issues before it is too late could mean that your budget is out of reach.

Do you have a budget that you regularly check? We'd love to hear your budget tips.

ACCOUNTING UPDATE

VAT reverse charge: the basics

The domestic reverse VAT charge for construction and building services comes into force on 1 October 2020. The new reverse charge will apply to any businesses or individuals that supply or receive specified services that are reported under the Construction Industry Scheme (CIS), and are registered for VAT in the UK. It will not apply if the service is zero-rated for VAT, or if the customer is not domestically registered for VAT.

What does it mean?

Any VAT incurred on the supply of a relevant service will be paid directly HMRC by the customer, not the supplier. The customer can then recover that VAT, in line with the normal rules for VAT recovery.

When is it happening?

Generally, before 1 October 2020 - normal VAT rules apply, and on or after 1 October 2020: the reverse charge applies.

What do I need to do?

Determine whether these changes will affect you. If they do, make sure that your accounting system has been updated and understand if this will impact the cash flow of the business after 1st October.

APP OF THE MONTH....

GOCARDLESS

With it's direct integration into Xero, GoCardless is an app that we recommend to all of our clients. It is a direct debit that auto collects on the invoice due date.

What can it do for me?

Protect the relationship with your customer.

By requesting your customer to sign up to GoCardless you no longer need to chase them for payment and can concentrate on providing a great product/service to your customer.

Gives you back time

GoCardless users typically spend 84% less time chasing unpaid invoices and 76% less time reconciling payments.

Improve your cash flow

You will have some certainty when your invoices will be paid which helps with your spending decisions.

Contact us if you would like to know how GoCardless could help you.

TEAM NEWS

The first Digital Accountancy Show magazine has been published and we are featured in it!

Katherine is an advisory board member of the Digital Accountancy Show and was interviewed in the first issue of the magazine. There is lots of new thought leadership and technology included in the magazine, so definitely worth a read.

Until next month,

Katherine and David

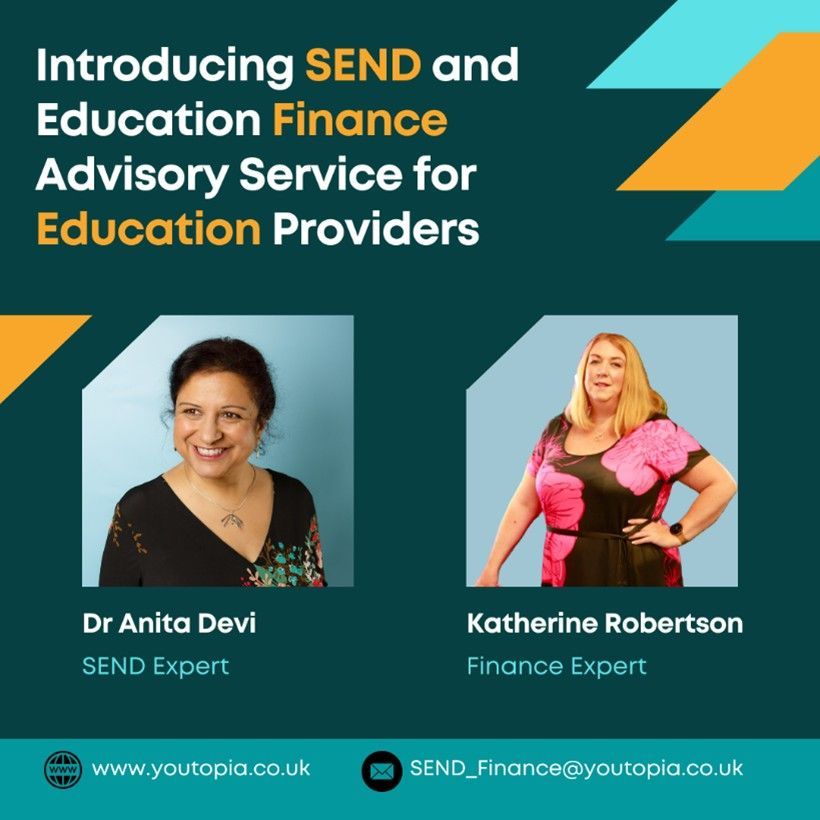

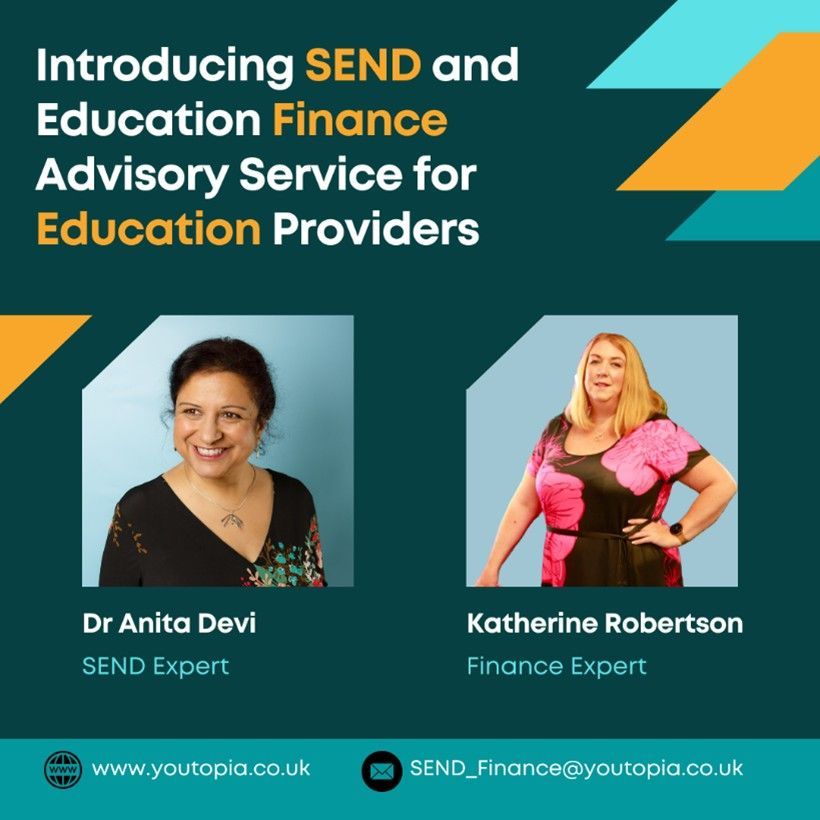

In Part 1 of this series, Dr Anita Devi opened the conversation on the rising complexity of SEND and the need for intentional, values-driven provision. Her reflections focused on inclusive leadership, purposeful commissioning, and the principle that less can often be more . In this second part, I’d like to continue the conversation — but from a financial perspective. My name is Katherine Robertson. I’ve spent over 10 years working with organisations across sectors including the education sector, helping them to navigate their finances confidently and strategically. What I’ve learned over that time is simple: money follows priorities — but only when we lead with clarity . And now, with SEND needs rising faster than school income, we must work smarter than ever with the resources we have. 🎯 From Stockpiling to Strategic Spending In 2024, the Department for Education wrote to 64 academy trusts, concerned that some were holding onto reserves more than 100% of their annual income . These aren’t just large numbers — they are untapped opportunities. Of course, we know why these reserves exist: financial uncertainty, poor capital funding, and the understandable desire to protect future viability. But if money meant for today’s pupils is held for tomorrow’s problems , we risk doing a disservice to the very learners we aim to support. That’s why we’re asking an important question: Can schools and trusts use their reserves to strengthen inclusion and SEND support now, without compromising their long-term financial security? Our answer is yes — with the right approach. 🧩 Applying Financial Wisdom to Inclusive Practice We are not advocating reckless spending or draining reserves dry. On the contrary, we work with leaders to build a clear, defensible strategy for using reserves wisely , backed by robust modelling, compliance with DfE guidance, and an unwavering focus on improving outcomes for children with SEND. Together with Dr Anita Devi, we bring dual lens: educational insight and financial clarity. Here’s how we help to: ● Identify untapped funding within existing reserves ● Co-develop an evidence-led SEND investment plan ● Align to DfE expectations on reserve levels and financial health ● Build the narrative for governors, trustees, auditors and regulators ● Support ongoing evaluation to ensure value for money and impact It’s not about spending more. It’s about spending better . 🔄 Releasing Funds. Reinforcing Purpose. SEND needs are not going away — and nor are the financial pressures. But when finance and inclusion experts work together, we can unlock solutions that support both pupil outcomes and institutional resilience . With careful planning, strategic reserve use can: ● Fund early intervention ● Invest in staff development ● Improve provision infrastructure ● And reduce future costs from reactive SEND placements or escalation It’s a long-term gain — and a value-led approach to financial governance. 💬 Let’s Continue the Conversation If you’re sitting on reserves and wondering how best to use them — or if you’re just ready to rethink how your SEND resources are working for you — we’re here to help. We offer a tailored advisory service that helps schools and trusts plan, invest and lead with both head and heart. 📩 Reach out at SEND_Finance@youtopia.co.uk to book a preliminary conversation. Because sometimes, the smartest way to save — is to spend with purpose. Author: Katherine Robertson Strategic Finance Expert and Education Consultant In partnership with Dr Anita Devi – Leading SEND Specialist

Inclusion is desirable, yet it is complex. In this two-part blog, we begin to unravel the challenges of increasing needs in education and diminishing resources. In this article, Dr Anita Devi explores some of the many challenges Educators in England currently face. Her intent is to extend perceptual thinking from problem to solution. In Part 2, Katherine Robertson will unpick some of the financial levers for consideration. I have worked in the education sector for a fair few decades now. Am I showing my age? Possibly, but also my experience and out of that experience is born wisdom. Wisdom is applied knowledge with the benefit of lived experience and hindsight. To broaden our thinking, I have decided to focus on three areas: Rising needs in the classroom – ensuring each child receives an educational experience that is progressive, whilst meeting their needs Less is more – applying a structured and systematic approach to providing support for special educational needs and disability (SEND) Commissioning with purpose – intentionally involving others, when needed. Since the increase in needs always outmatches the rise in resource funding, sadly we will always be in a deficit. This is not about being despondent, but hopeful through responsive and creative solutions. In many life situations, we face elements of the unknown and so we put in place checks and balances to ensure we maintain stability. If our own personal finances were continuously in the red, we would be faced with three options: Reduce spending Increase income Look for alternatives In the education world whilst options 1 and 2 may be possible to some degree, it is restricted and ultimately option 3 has been our default; especially if we are to adhere to the core principles of The Salamanca Statement (1994) and more closely to home, The Children and Families’ Act 2014. Rising need in the classroom Those who lead on inclusion and /or SEND need to simplify systems to ensure those learners who require additional and adaptive provision receive it. I have expanded more on this in a July 2023 booklet, which you can download here . If as a leader, you understand the fundamentals of an inclusive provision framework, you can reduce the paper trail to make it purposeful, without compromising on keeping a diligent paper trail of evidence. This will also ensure you know whether what is in place is having an impact or not. SEND: It is time to lead differently . Less is more There are a number of core decisions to be made when additional provision is put in place. For example, in or out of the classroom? How long is the defined additional support required and most importantly what is the expected outcome from the additional support? For far too long, we have assumed the ‘forever’ model when it comes to interventions or additional support. We have often omitted to discern short-term from long-term, as well as factor in the negative impact of too many interventions simultaneously. Short-term interventions, if assessed and targeted well can (in many instances) provide the learner with new skills and/or increased independence. This is a desirable outcome, as none of us is truly seeking to create a dependency model. Equally, administering too many interventions simultaneously takes away from the exploratory nature of interventions i.e. what’s working and what needs to change. We have indeed moved away from the ‘medical model’, however, some of the basic principles still need to be considered. In response to a medical condition, a doctor would not prescribe multiple medications or remedies simultaneously. Due care and consideration would be given to the negative interactive impact of one solution upon another. We need to apply a similar approach to inclusion and SEND. This is not denying that a child may have multiple needs, but sometimes it is about focusing on one thing at a time. Commissioning with Purpose This has been a bugbear of mine since 2018 , if not before! As a previous SEND Advisory Teacher, I was always intentional about ‘adding value’ to what is already in place in any setting. As a previous Senior Leader / SENCO, I was always intentional about securing services that provided ‘value for money’. I’ve worked with The Audit Commission on this and The National Audit Office, not to mention Business Managers and local authorities. I would also encourage readers to explore their ‘decommissioning process’. As a long-standing Education Change Consultant, my team & I always write our exit plans before we go into support. This is regardless of whether we are working in the UK or overseas. I am continuously amazed how many schools/colleges rely on the same service for years, even if there is no impact evidence of change through the input they are buying in. Over the years, training head teachers at national conferences, I have always advocated ‘procurement with precision’. Even at local authority level, I think provision would be better if Porter’s Forces were applied during the annual review of an EHCP in regard to placement choices, especially non-maintained Independent schools (NMIs). Supplier power through exuberant price hikes, in a time when there is a shortage of places, is both immoral and financially unsustainable. This is just the start of the conversation, but with a few systemic tweaks – schools and colleges can begin to look differently at provision. Still meeting the needs of children and young people but reducing the strain on financial resources and human manpower. Do get in touch if you would like to find out more. Author: Dr Anita Devi dr. h.c. Dr Anita Devi , leading SEND specialist, and Katherine Robertson , strategic finance expert, have joined forces to offer a new advisory service for schools and colleges . This service is designed to provide strategic financial governance of SEND provision, focusing on efficiency, effectiveness, and value for money . We help you explore financially sustainable solutions that support early intervention, improve outcomes, and make the most of every pound spent, without compromising on quality. If you're ready to rethink how SEND resources are used in your setting, contact us for a preliminary conversation at SEND_Finance@youtopia.co.uk 📢 And keep an eye out for our upcoming blog