September 22 Newsletter

Create a business plan - Here's how.

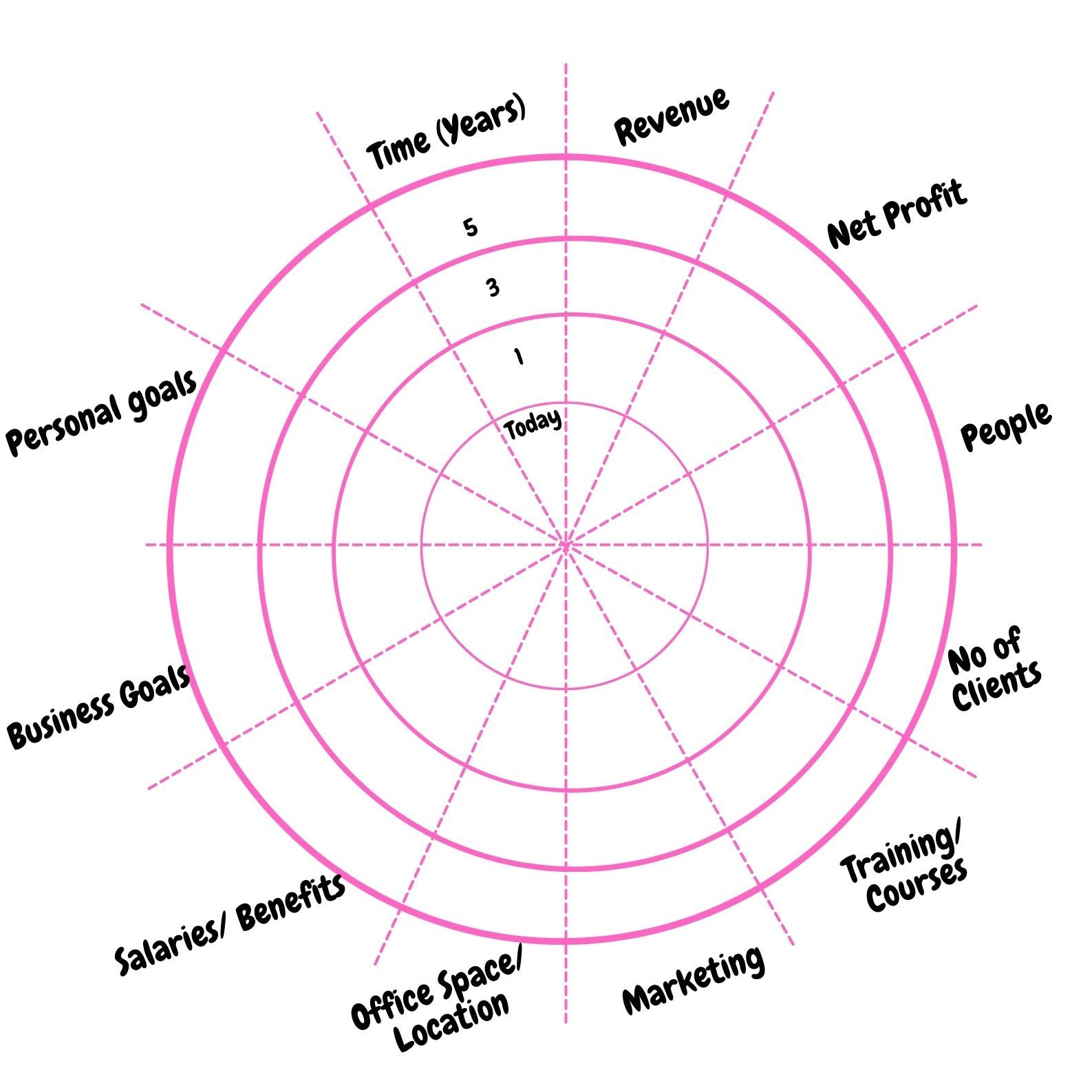

‘Fail to plan, plan to fail’, as the saying goes. If you're going to create an effective, successful and profitable business, you need to create a solid strategic plan.

Your business plan is the route map that defines your goals, explains your strategy and gives real direction to the everyday running of the company.

So what should you include in your plan?

5 key elements to include in your business plan

To create a truly robust and meaningful plan:

- Outline your vision – explain WHY you’re in business and how you intend to add value for customers. For example ‘We promote a healthy lifestyle through organic produce’.

- Set out your goals – outline your personal goals as a founder, and your wider strategic goals for the business. Then explain how these key goals are aligned. If your aim is to exit in 10 years, build this into your long-term plan.

- Define your funding and budget – to start trading, you need finance, so outline the investment that’s needed and how you’ll access that funding. Then break down this initial investment pot into clear budgets for each operational area.

- Forecast sales and cashflow – define the profit number you need, then calculate the volume of sales needed to deliver that income – and give a clear breakdown of the cash inflows and outflows needed to achieve positive cashflow.

- Set your timelines for success – set key milestones and give the business some concrete deadlines for meeting the goals, sales and revenues that you’ve projected.

Talk to us about creating a watertight business plan.

We’ll help you define your purpose as a business, and systematically set out how you’ll achieve your aims, giving you the best possible blueprint for success.

Our 1 page business plan is above.

Get in touch and let’s start planning.

Why are some expenses not allowed for tax?

As a business owner, you’ll be looking for every opportunity to claim back expenses and minimise your tax liability. But not everything that falls under expenses is tax-deductible.

To give you a better understanding of which costs are allowed and which are not allowed, we’ve highlighted the main areas where business owners habitually trip up with their expense claims.

How do you know if expenses are allowable?

The starting point for working out if expenses are (or are not) deductible for tax is the total costs shown in your company accounts. Take a look at your profit and loss (P&L) report in your accounts and you’ll see a list of all the expenses you’ve incurred over the period.

Once you have a list of your total costs, you can then follow the guidelines in the Government’s legislation to disallow some of these costs. At this point, you can also make any allowable deductions that weren’t included as costs in your standard accounts.

Which are the most common disallowed costs?

Disallowed costs are the expenses that can’t be claimed against tax. These disallowed costs fall into two main groups:

- Costs relating to capital (the money you have in the business to trade and grow)

- Costs that are not incurred wholly and exclusively for the purposes of trade.

Where fixed assets such as a van, a computer or a piece of machinery is purchased, the accounts will include a depreciation charge each year. This is intended to spread the cost in the accounts over the life of the asset. Although these depreciation charges are shown as expenses in the accounts, they’re added back to profits (i.e. disallowed) when working out how much corporation tax is due.

There is specific legislation which, in many cases, allows an alternative deduction. An alternative deduction can be made via the:

How do you know if expenses were ‘for the purposes of trade’?

It’s fairly easy to identify capital expenses that must be excluded. But knowing if expenses were incurred ‘wholly and exclusively for the purposes of trade’ can be more difficult.

Where expenditure has been incurred for a dual purpose (business and non-business) the whole of the expenditure is disallowed. This is commonly where many business owners fall down when claiming for costs that are actually excluded.

- Business clothing – one common area is business attire, where it may be customary to wear a particular type of clothing – say a suit – for business purposes. However, the reality is that the cost is disallowed because it also has an additional (dual) purpose. We wear clothes not just for business purposes but also for reasons of public decency.

- Staying at a hotel for business – in some cases, it may be possible to distinguish between the business and non-business element. In these cases, the cost of the business element will be allowed. For example, you might stay in a hotel for a week while attending business meetings, then stay on for some extra time for site-seeing. In this scenario, it’s reasonable to split the hotel bill into the business and non-business elements – and claim only the business expense.

- Business entertaining – some non-capital costs are disallowed even if they are incurred purely for business purposes. The most common example of this is business entertaining. Although it’s normal to entertain customers and prospects in the course of business, the cost of doing so is disallowed for tax. You can, however, claim for entertaining your own staff, under certain conditions.

- Working on a Pacific island! - sometimes, the non-business element could just be an incidental part of the main business requirement. For example a director may be working in an exotic location and enjoy the sandy beaches whilst they are there. As long as there is an objective business requirement for that location then the incidental enjoyment that it gives the director doesn’t prevent the cost being allowed. However, if the venue was chosen primarily so the director could work on their tan, the travel (and possibly accommodation) would not be allowable for business purposes. As you can see, it’s complex!

- Penalties relating to late-payment of tax – another common disallowable expense is the penalties, interest and surcharges arising on late payment of tax or late submission of tax returns. These costs cannot be claimed under any circumstances.

Just to add to the complexity, some expenses that are not incurred for the purposes of trade are specifically allowable for tax purposes. These include redundancy costs, retraining costs and pre-trading expenses (but only those that would be deductible if incurred after trade started).

Talk to us about maximising your allowable expenses

It’s important to make sure your expenses are given the correct tax treatment. Making a mistake can result in you paying either too much tax or becoming liable for penalties.

As with all matters related to tax, the rules are complicated and often unclear. Working with an experienced tax adviser makes good sense and helps you get on top of your expense claims.

We’ll help you maximise the potential tax deductions by advising you on any grey areas.

Get in touch to talk through your allowable expenses.